By Mohamed Fofanah.

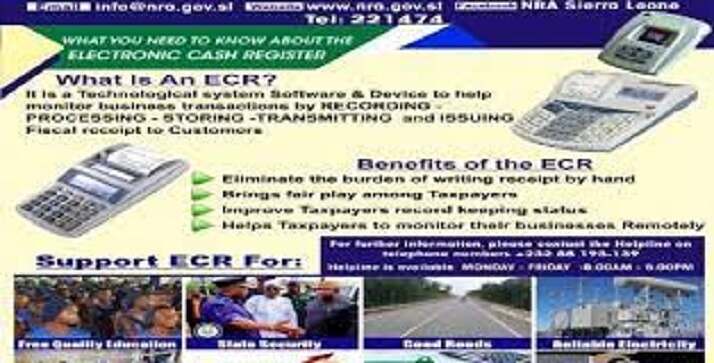

The Commissioner-General of the National Revenue Authority (NRA) yesterday clarified that the electronic cash register (ECR) machines are “not added taxes” but “mere calculators” installed in every registered GST business to invoice and record all transactions.

The tax itself according to Dr Samuel S. Jibao was introduced in 2009-he GST Act enacted by Members of Parliament to provide for the imposition of a broad-based tax on the consumption of goods and services in Sierra Leone and to provide for other related matters.

Dr Jibao announced at a press conference held at the NRA headquarters in Freetown that the tax authority is not only restricted to generating revenue but also facilitates trade to enhance Government fiscal space for national development.

He said the ECR machine is legislated and denying its installation in a registered GST business impugns tax administration and will be punishable by law and system-generated penalties between SLL100 to SLL250 million.

Dr Jibao revealed that so far Indian and other foreign-owned businesses have been compliant with the use of the ECR machines, while the NRA still faces challenges to install them in businesses owned and operated by Sierra Leoneans.

He described those who ignore using an ECR machine to issue out receipts to customers after every sale as running “illegal businesses,” noting that it is unfair not to pay tax to the Government of Sierra Leone.

NRA’s enforcement tools in tax administration include a third party recovery/garnishment of account, prevention from traveling in and out of Sierra Leone, prevention from clearing goods from the ports, closure/sealing of business premises, naming and shaming, a public auction of goods and services and other assets, and court action.

The ECR is part of reforms taking place at the NRA including ASYCUDA World, integrated tax administration system (ITAS), BMS, DTPS, and Electronic Single Window, possible because of a strong political will, transparent, and accountable systems to generate the revenue, according to Dr Jibao.